Decentralized finance (DeFi) has emerged as a disruptive force in the financial/capital/banking industry, leveraging blockchain technology to create/develop/establish innovative financial applications. At the heart of DeFi lies the adoption/utilization/integration of digital currencies, such as Bitcoin and Ethereum, which provide a secure/transparent/immutable platform for transactions and value exchange. These cryptocurrencies operate independently of centralized/traditional/conventional institutions, empowering users with greater control/autonomy/ownership over their funds/assets/wealth.

- DeFi protocols enable a wide range of financial/copyright/blockchain services, including lending, borrowing, trading, and yield farming.

- Smart contracts, self-executing agreements coded on the blockchain, facilitate/automate/govern these transactions, ensuring transparency/security/trust and reducing/eliminating/minimizing the need for intermediaries.

- The decentralized nature of DeFi offers numerous advantages/benefits/opportunities, such as increased accessibility, lower fees, and greater financial/economic/algorithmic inclusion.

As DeFi continues to evolve, it has the potential to revolutionize the global/traditional/modern financial landscape, providing innovative solutions for a more efficient/inclusive/decentralized future.

Embarking on the Volatile World of copyright Assets

The realm of copyright assets is notoriously volatile, demanding a proactive approach from investors. Shifts in market sentiment can occur with lightning-fast speed, making it critical for investors to cultivate a deep understanding of the underlying technologies. Building a strategic portfolio across various assets, coupled with meticulous research and risk management strategies, is crucial for thriving in this ever-evolving environment.

Decentralized Ledger Technology : The Backbone of Digital Money

Blockchain technology has emerged as a revolutionary force in the realm of finance, serving as the bedrock for digital currencies and transforming how we transact value. Its inherent characteristics, such as immutability, transparency, and security, make it an ideal platform for building trust and facilitating secure transactions. By leveraging cryptography and a distributed network of computers, blockchain enables peer-to-peer communications without the need for intermediaries, fostering a more streamlined financial system.

The decentralized nature of blockchain reduces the risk of single points of failure and tampering, ensuring the integrity and authenticity of digital records. This inherent trust mechanism has paved the way for the adoption of cryptocurrencies like Bitcoin and Ethereum, which have attained widespread recognition as legitimate forms of payment.

- Additionally, blockchain technology holds immense potential beyond digital currencies, with applications spanning diverse industries such as supply chain management, healthcare, and voting systems.

Digital Currency: Revolutionizing Payments and Transactions

Digital tokens is rapidly changing the way we transact. Blockchain technology, the foundation of digital currencies, allows for secure and open transactions excluding traditional financial institutions.

This development offers various advantages, such as lower transaction fees, increased speed of payments, and improved financial inclusion for underserved populations.

, Additionally, digital tokens offer new possibilities for companies to develop new products and streamline their activities.

While the challenges associated with regulation and acceptance, digital currency is poised to revolutionize the financial landscape in the years to come.

The Future of Finance: Exploring the Potential of Digital Currencies

The financial landscape is undergoing a dramatic shift with the emergence of digital currencies. These decentralized, cryptographic assets challenge traditional financial systems by offering secure transactions and removing intermediaries. As adoption grows, digital currencies promise the potential to modernize sectors like payments, lending, and investment, driving new opportunities for individuals and businesses alike.

Regulatory institutions worldwide are actively exploring the implications of digital currencies, striving to click here establish regulatory frameworks that balance innovation while mitigating risks. The future of finance is evolving, and digital currencies are poised to play a central role in shaping the economic landscape of tomorrow.

Understanding the Risks and Rewards of Digital Currency Investments

Digital currencies, like Bitcoin and Ethereum, have surged in popularity in recent years, attracting both enthusiastic speculators. While the potential for significant returns is alluring, it's crucial to fully grasp the inherent risks involved.

One major risk is fluctuation, as digital currency prices can swing drastically in short periods. This volatile nature makes it essential to invest only what you can afford to risk.

Another concern is the limited governance surrounding digital currencies. This creates opportunities for fraud and scams, so it's vital to conduct thorough research and choose reputable exchanges and platforms.

- Furthermore, technological advancements and regulatory changes can drastically alter the digital currency landscape, requiring investors to stay abreast of industry developments.

Despite these risks, digital currencies also offer compelling rewards. Their lack of central authority can provide enhanced protection against fraud.

In conclusion, understanding both the risks and rewards is paramount for making informed investment decisions. Remember to invest responsibly, diversify your portfolio, and always conduct due diligence before committing funds.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Brandy Then & Now!

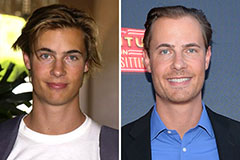

Brandy Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!